The crypto wallet where security meets convenience

Advanced Threshold Signature cryptography makes crypto ownership easy, safe, and always in your control

Leading technology trusted by industry experts

Advanced storage means ultimate security

Distributed storage protects against loss

Cutting-edge cryptography distributes your crypto across multiple devices

Social recovery means peace of mind

Avoid mistakes with a network of trusted Guardians that can help recover lost crypto

True ownership for full control

You are always the only one in control. No one can access your crypto other than you

Quick and easy setup

Buy, store, and use crypto effortlessly

Unbeatable protection and peace of mind

All the security none of the work

Unique storage system makes crypto ownership easy and safe without complicated setup

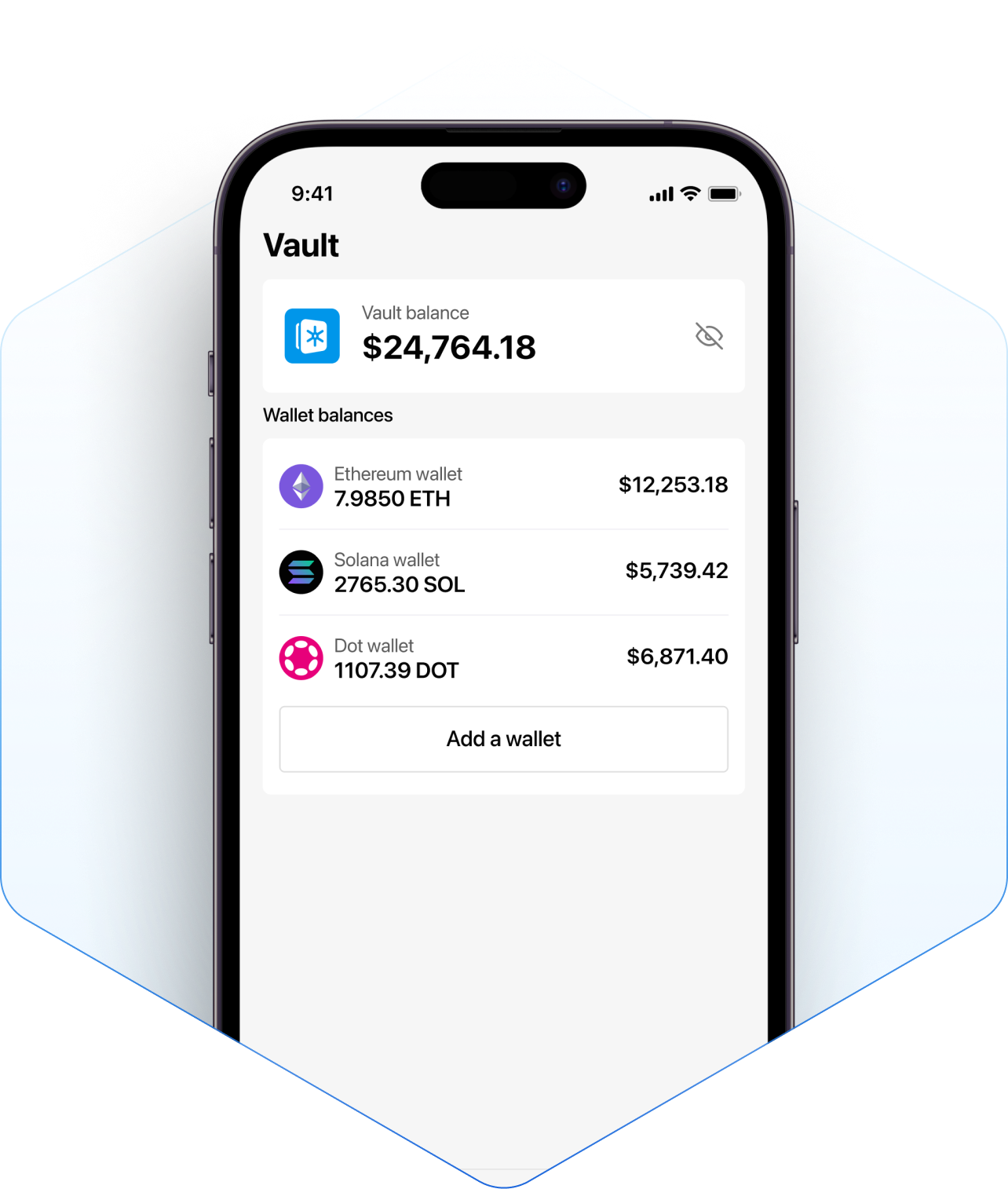

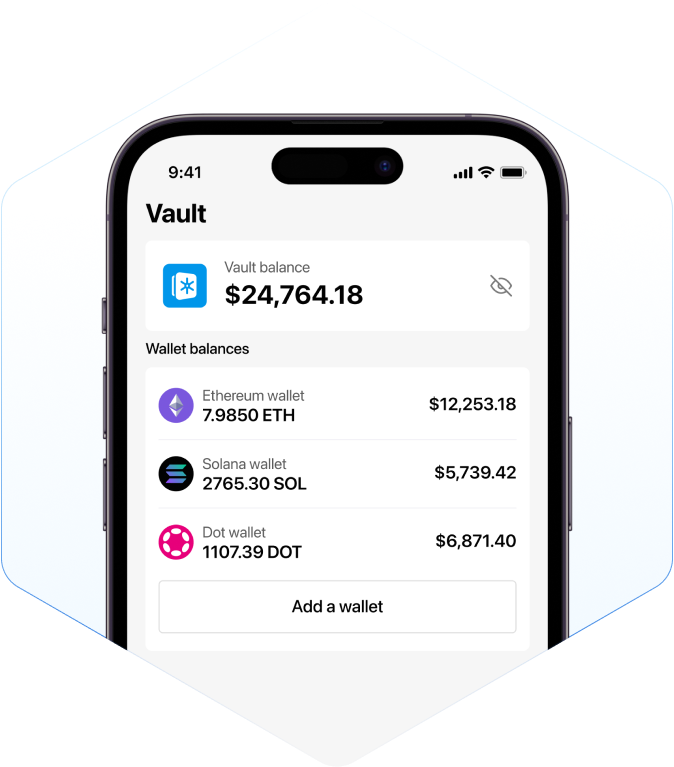

Multi-chain support.

Store all your crypto and NFTs safely in one place

Backed and supported by

Download Gridlock