USDC wallet

Buy USDC in minutes

A no-nonsense app and Industry-leading technology makes USDC investment simple, easy, and safe

Buy and secure your USDC (USDC) in just a few minutes

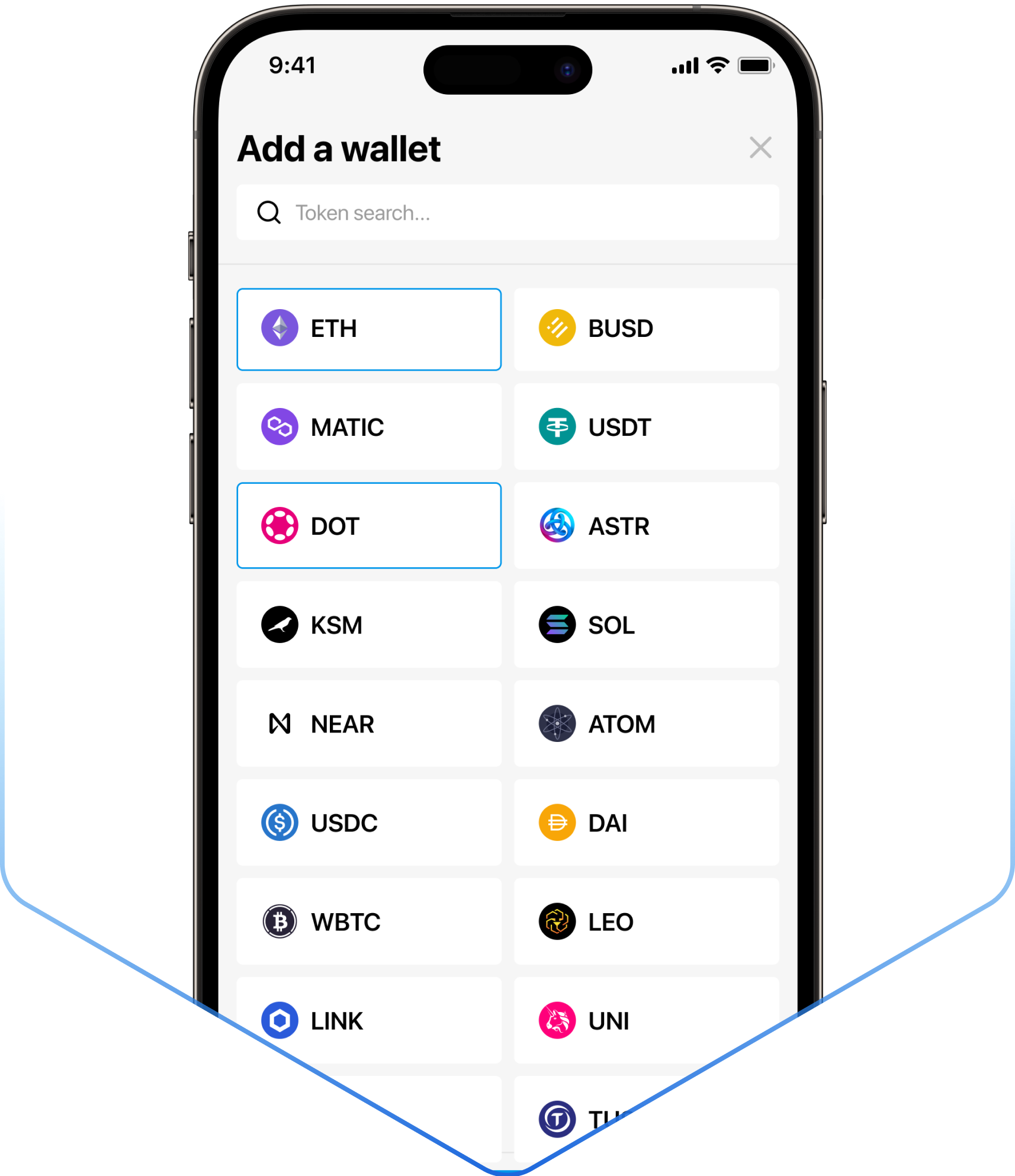

1. Download Gridlock Wallet

Gridlock is a free and secure place to manage Bitcoin, USDC, and hundreds of other assets.

2. Setup your account

Adding guardians is a quick and easy way to turn a regular wallet into an ironclad vault. Say goodbye to the hassle of seed phrases; with guardians, recovery is worry-free and effortless.

3. Get USDC USDC

Invest as little as $50 or as much as $18,000 daily. Crypto is transferred directly to your wallet. Credit/Debit cards accepted.

Secure your USDC wallet with Gridlock

Ultimate Protection

Secure your digital assets with unparalleled safety through Gridlock. Our innovative distribution method ensures that there is no single point of failure, significantly reducing the risk of loss or theft. By spreading your crypto assets across multiple secure locations, Gridlock offers a level of safety that stands out in the world of digital currency storage.

Total control

Have absolute control over your cryptocurrency with Gridlock. Our system empowers you to be the sole authority over your digital assets. With Gridlock, there`s no reliance on intermediaries or external entities for access or management. You have the exclusive control, always.

Effortless ownership

Enjoy peace of mind with Gridlock`s effortless management. Our system proactively monitors and maintains your storage network, ensuring it remains secure and up-to-date. You don`t need to be a crypto expert to have expert-level protection. Gridlock works in the background, providing a seamless experience that keeps your digital currencies protected without the extra effort on your part.

Loss Recovery

Recover lost crypto confidently with Gridlock. Our unique system allows you to easily recover USDC and other digital currencies with the help of your guardians. This distinctive approach sets Gridlock apart as the leader in safe crypto storage.

USDC

USD Coin (USDC) stands as a prominent example of a stablecoin—its value is anchored to the US dollar, ensuring that each USDC token corresponds to one dollar held in reserve. USD Coin serves as a crucial bridge, allowing easy transition between traditional currency and the dynamic world of cryptocurrency exchanges. This stability is particularly important for those in the cryptocurrency community seeking refuge from the often volatile market fluctuations, as USDC provides a dependable haven for funds without needing to revert to fiat currency.

Issued by the Centre Consortium, USDC ensures seamless exchanges of value among individuals, businesses, and financial institutions. The coin operates with a clear structure: when you purchase USDC with fiat currency, that currency is held in reserve, and an equivalent USDC is minted. Conversely, when USDC is sold, the corresponding token is "burned," and the equivalent fiat is returned to the user's bank account.

The reserve assets backing USDC are housed in separate accounts within U.S.-regulated financial institutions, with oversight and monthly attestations provided by the accounting firm Deloitte. This transparent process offers users a level of security and confidence in the stability of their digital assets.

USDC boasts compatibility with numerous blockchain platforms, including Ethereum, Algorand, Solana, Stellar, and TRON. The coin is a product of the collaborative efforts of Centre—a consortium co-founded by industry heavyweights—and aims to revolutionize the financial sector by interconnecting currencies and financial services globally.

Though USDC is celebrated for its low volatility and strong backing, it's not without its caveats. For instance, it doesn't offer price appreciation like other cryptocurrencies, and the exact composition of its reserve assets may not be fully disclosed. Moreover, as a stablecoin, it cannot escape the inflationary tendencies inherent to the U.S. dollar it mirrors.

To delve deeper into the specifics of USD Coin and its operational structure, an exploration of the website could prove enlightening: USD Coin website.

By understanding the intricacies of USDC, investors and users can make informed decisions that align with their financial goals and requirements in the ever-evolving landscape of digital currencies.

Types of USDC Wallets

Picking out the best USDC wallet is easy once you understand the options available. There are many different types of USDC wallets out there, with some designed for rock-solid security, others built for ease of use, and a few that offer a bit of both.

Software Wallet

Software wallets are the most common option and are a quick way to store USDC. They can be apps on your phone, add-ons in your web browser, or even websites. To get started, download the wallet of choice, make an account, and soon, you are set up to store or transfer your crypto.

But there's a catch. Your encryption key is not as safe in these types of wallets. The encryption key is like a super-secret password for your USDC and is kept on the web or in your browser. That's why these are called "hot wallets." These wallets work online, which means they're more accessible to hackers, and if they get your encryption key, you lose all of your USDC.

Securely managing software wallets can be tricky as well. They use something called a seed phrase—a list of words that lets you into your wallet. Mix up these words or forget them, and you will forever lose access to your wallet! One mistake and your USDC is lost.

These issues make it clear that while software wallets are handy for quick buys and moving money around, they have risks.

Hardware Wallets

Hardware wallets are compact, portable vaults that securely store the unique keys for your USDC and keep those keys offline and away from hackers. This means they're not connected to potentially vulnerable internet-linked devices like computers. To use them, you must physically connect these wallets to your computer when transferring your USDC.

The offline nature of hardware wallets provides a strong barrier against hackers, as your secret keys are not accessible via the internet. These devices are secured with a PIN or password to protect from someone stealing all of your USDC if they find your hardware wallet.

However, there are notable drawbacks to hardware wallets. They're not the most convenient for regular, day-to-day transactions. Each time you need to make a transaction, you must physically connect your hardware wallet to a device, which can be cumbersome. This process can be a significant hassle and potentially a missed selling opportunity if there is a big change in the price of USDC.

Using hardware wallets can be tricky, especially for people new to cryptocurrency. These wallets differ from online or phone wallets because you need to know more about keeping and moving your digital money safely. You have to be careful with many security steps and learn how to connect the wallet to other places to make payments. You could lose your USDC if you make a mistake, like mixing up private keys or not following the right steps.

Hardware wallets also have a big flaw because they keep all your digital money in one place, on one fragile piece of plastic. If you lose the wallet, it breaks or stops working; you might not be able to get your money. These wallets usually have a backup plan using special phrases, but getting your USDC back this way can be complex and could fail outright if you've lost your seed phrase. If you lose these backup phrases or someone steals them, your USDC is gone forever.

Web Wallets

A web wallet, which is usually part of an exchange, is another way to store USDC, but they come with risks. A big part of these wallets is that they are "custodial," which means the website or service holds onto your encryption key – the super-secret code that locks and unlocks access to your USDC.

Here's the catch with custodial wallets and exchanges: when someone else has your encryption key, they have full control of your crypto, and you have no control. There's a common saying in the crypto world, "Not your keys, not your coins." This means you don't own your crypto if you don't control the keys. So, if the people running these wallets or exchanges are not reliable or make mistakes, you could lose all your cryptocurrency.

For example, if the website gets hacked, has technical problems, or even if the people running it are dishonest, your USDC could be at risk. Since they hold your keys, they control your USDC, and if something goes wrong on their end, you might not be able to get your crypto back. This is why many people are cautious about keeping their crypto in custodial wallets or exchanges, especially for long-term storage. They're often flashy and convenient for trading, but they are not the safest place to keep your digital money for a long time.

Gridlock Wallet

The Gridlock Wallet is a modern solution for storing USDC, offering a unique blend of features that set it apart from traditional hardware and software wallets. This is possible because Gridlock is a distributed USDC wallet.

Unlike hardware wallets, which are reliant on a single device, the Gridlock Wallet doesn't rely on a single device, making it less risky in terms of physical loss or damage. It's also more user-friendly, eliminating the complex steps that often make hardware wallets daunting, especially for newcomers.

In contrast to software wallets, which often leave users juggling complex seed phrases and facing the risk of a single point of failure, the Gridlock Wallet offers a significantly higher level of security. Its distributed nature means it does not rely on a single password or code, making it a stronger, smarter choice for protecting your digital money.

Gridlock Wallet offers a secure and user-controlled alternative to web wallets and exchanges. Web wallets, which are often custodial, pose risks like hacking and potential mismanagement by the wallet providers. Gridlock users maintain full control over their encryption keys, greatly reducing the risk of losing USDC due to these external factors.

Lastly, the Gridlock Wallet simplifies the recovery process. Where other wallets depend on complex seed phrases susceptible to loss and theft, Gridlock provides a much simpler and safer way to regain access to your account based on the novel guardian protection mechanism.

Overall, the Gridlock Wallet emerges as a comprehensive option for those seeking the security of a hardware wallet, the convenience of a software wallet, and the true ownership of a non-custodial solution. Its design addresses the common pitfalls of all alternatives, making it an attractive choice for secure and hassle-free USDC ownership.

Remember, when you're picking a wallet for your USDC, it's all about what fits your needs and keeps you feeling secure. Whether it's the quick software wallet, the secure-but-complex hardware wallet, the risky web wallet, or the super-smart Gridlock wallet, choose the one that's right for you and your USDC.

Discover other cryptocurrencies supported by Gridlock Wallet

With Gridlock, you can safely store over 1000 cryptocurrencies, including these listed below.